Will inflation make a comeback after the crisis ends?

The world economy has come to a shuddering halt in the wake of government policies aimed at reducing the impact of COVID-19 (Baldwin and Weder di Mauro 2020). Hundreds of millions of lives have already been transformed and the massive short-run disruption is leading many to conclude that the future will also be transformed. In particular, there is a growing fear that wartime levels of fiscal deficits and massive expansions of the money stock will combine with lasting reductions in supply and a sharp recovery in demand to bring high inflation when the epidemic passes. Charles Goodhart and Manoj Pradhan, in their recent Vox column, remark that “[t]he coronavirus pandemic, and the supply shock that it has induced, will mark the dividing line between the deflationary forces of the last 30 to 40 years, and the resurgent inflation of the next two decades”.

There is great uncertainty about the path of the virus in the next few months, and even more about the path of the economy and society in the years ahead. It is far from clear that we will see high levels of inflation as a consequence of current government policies. Governments may be at war with COVID-19 and fiscal deficits and a shutdown of the economy may be a result of that war. There are, however, important differences with what occurred during and after military wars and they substantially reduce the size of inflationary risk on this occasion.

Where might this inflationary risk come from? The immediate response to the virus has created a simultaneous sharp fall in both supply and demand. Whilst the balance of supply and demand shifts is not the same across all sectors, so that major relative price shifts are occurring (academic output seems in particular to have surged as a result of lockdown policies as does the supply of zero priced webinars), it seems unlikely that overall inflation (almost impossible to measure accurately now anyway) has risen.

What about when recovery begins? Will a monetary overhang feed into surging demand and interact with reduced supply to trigger a rapid increase in prices? That the demand for goods and services may come back more strongly than supply is not obvious. The ‘end’ of the epidemic will not be an event like the end of a war. The first world war ended on 11 November 1918. This epidemic will not be like that. Infection rates and deaths will decline and, perhaps with much more widespread testing, it will become possible for a rising proportion of the population to return to more normal life. That will happen gradually over time. It is a process and not an event. Supply and demand will slowly rise. There will not be a day when people collectively wake up to find this is over and celebrate together with a simultaneous splurge of spending. Even though there may be VE (‘Victory over the Epidemic’) parties, they are likely to take the form of an evening of celebration after the event rather than a coordinated raft of buying of cars, houses and expensive items that sees consumer spending surge.

The imbalance between supply and demand also seems likely to be very different from those experienced in the aftermath of wars. During wars, government buys large amount of output and acts as an employer of first resort. The result is often high inflation during the war as demand outstrips the ability to supply non-war goods. Whilst Louis Vuitton is switching to make hand sanitisers and Dyson is making ventilators there has not been a wholesale shift towards producing ‘war goods’ and neither is the government acting as an employer of first resort, rather it is being an insurer of last resort. War also results in mass physical destruction of capital and a tragic heavy loss of life of those of working age. Thankfully this time does for once look to be different.

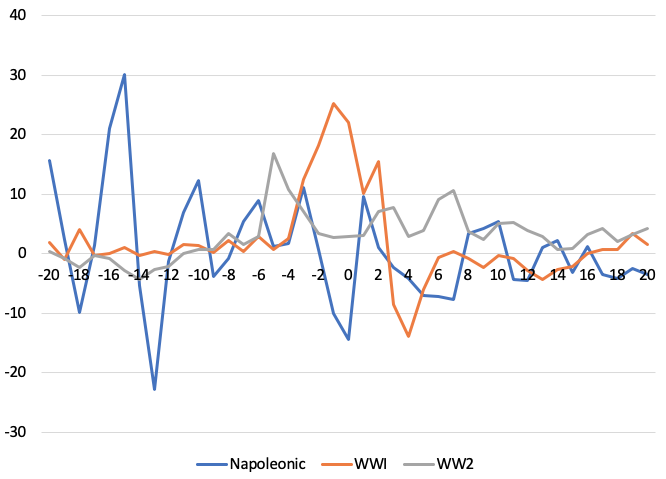

Source: Bank of England Historical Dataset

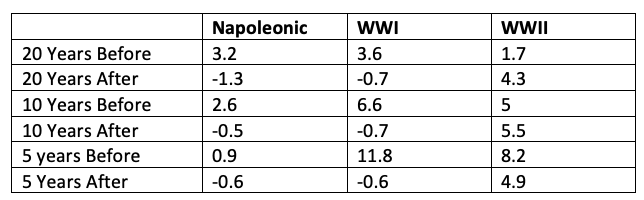

Figure 1 shows UK inflation 20 years before and 20 years after the end of three major conflicts (1815 Napoleonic War, WWI and WWII). These wars brought levels of UK government debt to 164%, 137% and 259% of GDP respectively. Evidently much is different across those three episodes compared to today, but little support can be given to the notion that the cessation of hostilities automatically leads to increases in inflation. Table 1 shows comparisons of average inflation 5,10 and 20 years before and after the end of these wars and in only one case (the 20 year window around WWII) is inflation substantially higher, and that may be more about including the Great Depression years in the pre-war interval rather than actual inflation in the post WWII one.

Table 1 Average inflation before and after three major conflicts

That isn’t to deny that governments use higher inflation to bring down the level of their liabilities. Three hundred plus years of UK data reveal that before the 20th century, war time debts were reduced mainly through future fiscal surpluses whereas since then (and with the extension of the franchise) high levels of debt/GDP have been reduced by higher inflation rather than surpluses (see Table 3 in Ellison and Scott 2017).

But as Table 1 shows, this doesn’t mean double digit levels of inflation. The debt reduction can occur over the very long term and doesn’t need to happen in a few years. If this is really a once in 50 years pandemic, then it should also be financed over a 50-year horizon. Further whilst government debt looks set to rise substantially in the next 12-18 months that looks likely to raise it by somewhere in the 10-30% GDP range – much smaller than the war time increases and, in the UK, taking it to far below previous peaks.

What about the surge in liquidity and the expansion of central bank’s balance sheets? The question, as with the financial crisis, is why should this be the key driver of inflation? The value of financial assets held by the private sector likely will be much lower after the pandemic. Think what has happened to stock prices and perhaps also the value of houses. The money supply may rise but the total value of the wealth of the private sector (even inclusive of housing and net of mortgages) is likely much more significant for consumption – and that wealth will very likely have gone down.

References

Baldwin, R and B Weder di Mauro (2020), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, a VoxEU.org eBook, CEPR Press.

Ellison, M and Scott, A (2017) “Managing the UK National Debt 1694-2017”, CEPR Discussion Paper 12304

Goodhart, C and and M Pradhan (2020), “Future imperfect after coronavirus”, VoxEU.org, 27 March.